Eurocontrol - Bizav up 2%

Wednesday, 12 August 2020

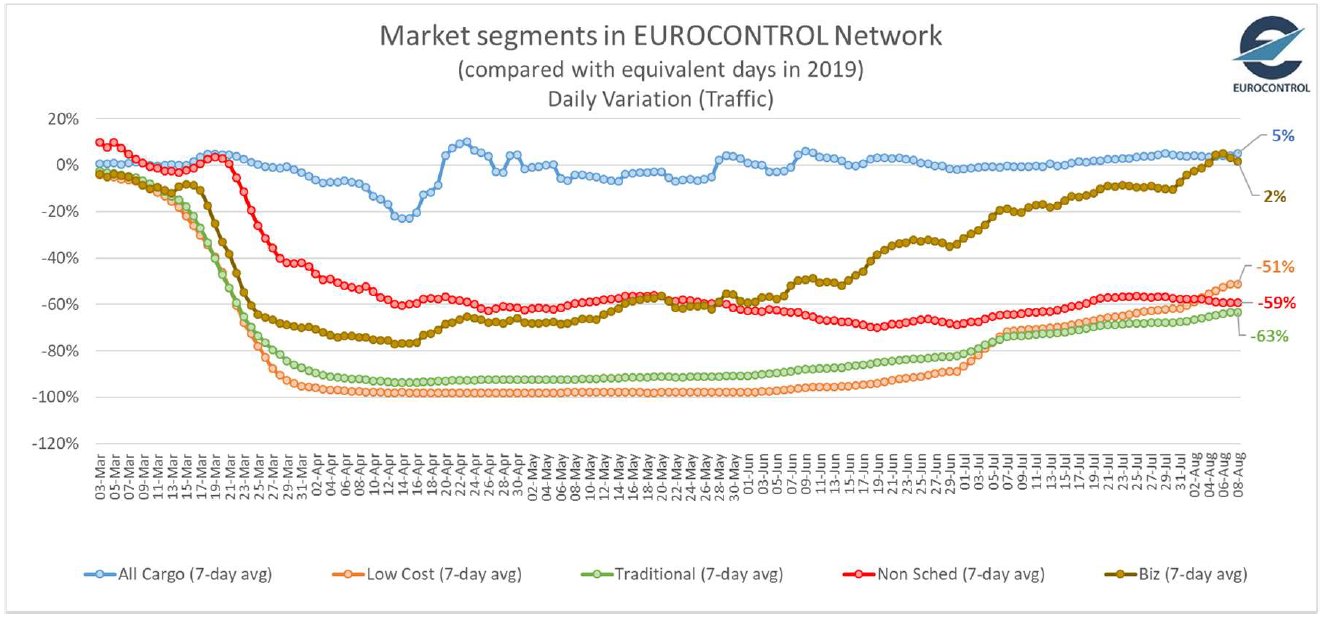

Traffic Situation & Airlines Recovery 15,660 flights on Tuesday 11 August (+11% and +1,561 flights compared to Tuesday 28 July) reaching 45% of 2019 levels. Noticeable schedules increases recorded on holiday destinations as of the beginning of August. Traffic growth rates are however less important week on week. Friday 7 August was peak traffic day since the end of March with 18,147 flights, 50.6% of the 2019 levels. With the Summer period, Mediterranean destinations (Spain, Italy, Greece and Turkey) record solid growth rates as they continue to attract tourists. On average, Load Factors (LF) for main European airlines in July are far below July 2019 levels ; however, LF can reach last year’s levels on holiday destinations (eg 90% reported by Austrian Airlines). New cases in some countries have led to travel restrictions being continued or re-imposed. It is likely that this will lead to ad-hoc cancellations. Traffic development in Europe in August so far is (-52%) in line with the EUROCONTROL “coordinated” scenario. Ryanair remains the busiest carrier with 1,473 flights on 11 August (+53% on 28 July) followed by easyJet (885 flights, +62%), Turkish Airlines (608 flights, +3%), Wizz Air (521 flights, +19%) and Lufthansa (436 flights, +12%). KLM recorded the biggest growth (+80%) increasing capacities all over Europe. Business Aviation has reached 2% above 2019 levels (on 8 August) thanks to the record interest from customers completely new to travel by private jet. All-cargo stable at 5% above last year’s levels. Low-cost, still 51% below 2019 levels, is recovering slightly faster than Traditional (63% below). The latest European NOP 2020 Recovery Plan expects traffic to be, potentially, close to 60% of the 2019 levels on peak days by September. This outlook is highly dependent on the evolution of State restrictions. As a result of some increases in new cases, some State restrictions have been imposed/re-instated.

Traffic Situation & Airlines Recovery 15,660 flights on Tuesday 11 August (+11% and +1,561 flights compared to Tuesday 28 July) reaching 45% of 2019 levels. Noticeable schedules increases recorded on holiday destinations as of the beginning of August. Traffic growth rates are however less important week on week. Friday 7 August was peak traffic day since the end of March with 18,147 flights, 50.6% of the 2019 levels. With the Summer period, Mediterranean destinations (Spain, Italy, Greece and Turkey) record solid growth rates as they continue to attract tourists. On average, Load Factors (LF) for main European airlines in July are far below July 2019 levels ; however, LF can reach last year’s levels on holiday destinations (eg 90% reported by Austrian Airlines). New cases in some countries have led to travel restrictions being continued or re-imposed. It is likely that this will lead to ad-hoc cancellations. Traffic development in Europe in August so far is (-52%) in line with the EUROCONTROL “coordinated” scenario. Ryanair remains the busiest carrier with 1,473 flights on 11 August (+53% on 28 July) followed by easyJet (885 flights, +62%), Turkish Airlines (608 flights, +3%), Wizz Air (521 flights, +19%) and Lufthansa (436 flights, +12%). KLM recorded the biggest growth (+80%) increasing capacities all over Europe. Business Aviation has reached 2% above 2019 levels (on 8 August) thanks to the record interest from customers completely new to travel by private jet. All-cargo stable at 5% above last year’s levels. Low-cost, still 51% below 2019 levels, is recovering slightly faster than Traditional (63% below). The latest European NOP 2020 Recovery Plan expects traffic to be, potentially, close to 60% of the 2019 levels on peak days by September. This outlook is highly dependent on the evolution of State restrictions. As a result of some increases in new cases, some State restrictions have been imposed/re-instated.